Money Machine using the Albert Einstein principle (Compound interest)

The snowball effect

Some time ago, I was at the dinner table when my 2 daughters, who were listening in on a conversation between my wife and I, asked me, “What is investing?”. From the conversation, they were able to glean that investing is a way to make lots of money with minimal work, and of course, being part of the zoomer generation, the idea seemed like a dream come true. I, of course, was thrilled that my progeny was finally showing interest in finance, but, my daughters are 8 and 10 years old.

How do I teach someone with so little experience and very basic mathematical skills how to invest? This forced me to think about the fundamental rules that they needed to internalize, and one of those key fundamental concepts is The Snow-ball Effect.

Finance folks like to overcomplicate things. They use terms like compound interest. Imagine me trying to explain that term to my 8 year old, who is still trying to work out her multiplication tables. After much consideration, I finally decided that the best way for me to explain this concept to them was to put in their minds the image of a snow-ball cartoon where a bit of money could grow and grow like a snowball rolling down a snow covered hill.

I like the quote from Albert Einstein which said (It’s very likely he didn’t say it but let’s credit it to him anyway) 😃:

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

I want to divide the quote in two sections to explain it in more detail:

Let’s start with the part where it says “he/she who doesn’t … pays it.” I know that you are anxious to start buying your first bitcoin 😂 🤑 but let me tell you, it is extremely important that you understand this principle. If you don’t understand the fundamentals how do you expect to understand advanced statistics etc. In my previous post I had mentioned that you need to do a self-assessment on your net worth. After you have done this exercise, you will come to find out if you have excessive debt or not, if you are paying too much interest or not, or if you have a negative balance. If you are in the red numbers, don’t worry too much. You are not alone.

Let me explain to you why…

I know that I might have different types of readers for this blog from different life stories however, in US a typical standard life pattern looks like the following regarding debt:

When someone finishes their studies through university, in most cases they’ll have high student debt with low assets. So, they’ll probably be in debt (negative balance, if you will). Then, he or she will get a job, rent a place, and at some point save enough for the downpayment to buy “The house with the white picket fence”. They try to keep debt under control or low. However, most folks don’t know how to handle good debt (debt where you buy income-producing assets) and instead, they increase their bad debt (assets that they lose value or don’t generate income), and the cycle continues. Over the years, they’ll pay off the mortgage and reach minimal or zero debt and then they die. Kind of dramatic but true.

As I mentioned before, my daughters belong to the Zoomer generation. I doubt they would follow this pattern, and hopefully, with some of the knowledge that I’m explaining to them they can be financially free before they reach their 20s. So, my intention with this blog is to help you to navigate and improve your financial goals. In short, it really depends on your situation but the important principle to remember here is:

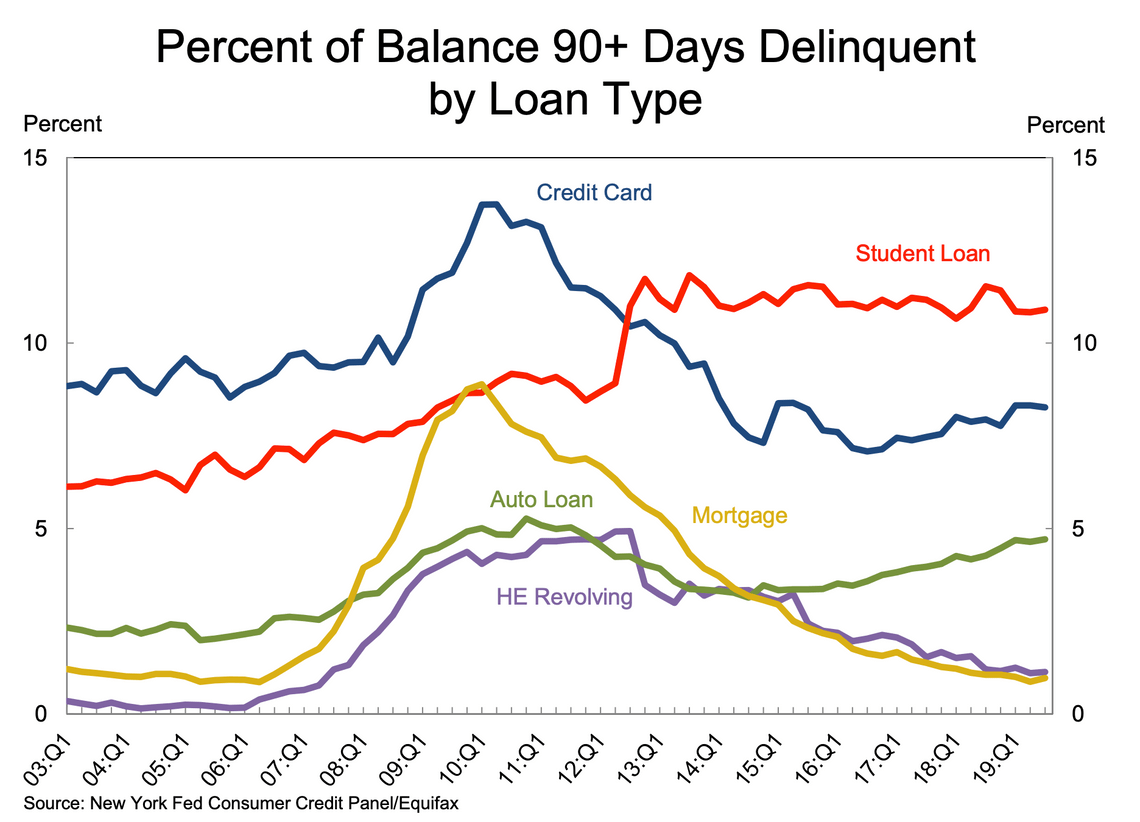

Pay attention to Albert Einstein’s quote: You need to have zero or minimize the interest that you are paying before you start investing, it would be silly to start investing when you are in negative balance amigo(a). Take a look on the following chart:

If you notice the most delinquent debt are student loans and followed by credit cards. I want to stress out that before you start investing you need to realize that there are risks involved so make sure that your credit cards are in low balance and your student loans have a very low-interest rate or paid off.

Here are some tips to lower your interest rates.

Simply call and ask. Duhh! ~ maybe sounds obvious but so many folks do not want to pick up the phone and spend 15mins. There’s probably a customer service number on the back of your credit card. Most people ignore this unless they find themselves in a really sticky situation, but customer service is there for a reason. Arm yourself with competitors’ information, know what you’re asking for, and simply make the call. It can’t hurt to ask, right? It seems too simple, and that’s why so few people actually take the initiative to do it. But that easily can bring your credit card interest down.

Debt consolidation. There are some services out there to help you to do a debt consolidation however make sure that if you have a lot of debt you don’t fall again and spend the money in bogus and useless crap. Statistics show that 78% of the people that do debt consolidation go back to being under the water because they don’t have a plan how to get out of debt. So please do yourself a favor and pay-out your debt as soon as possible.

0% interest with a line of credit. If you have good credit score you can calculate if maybe you can pay your debt in one year or less you can use tools from the internet like https://www.creditkarma.com/calculators/debtrepayment. To help you to verify and be on top of your credit FICO score if you live in the US.

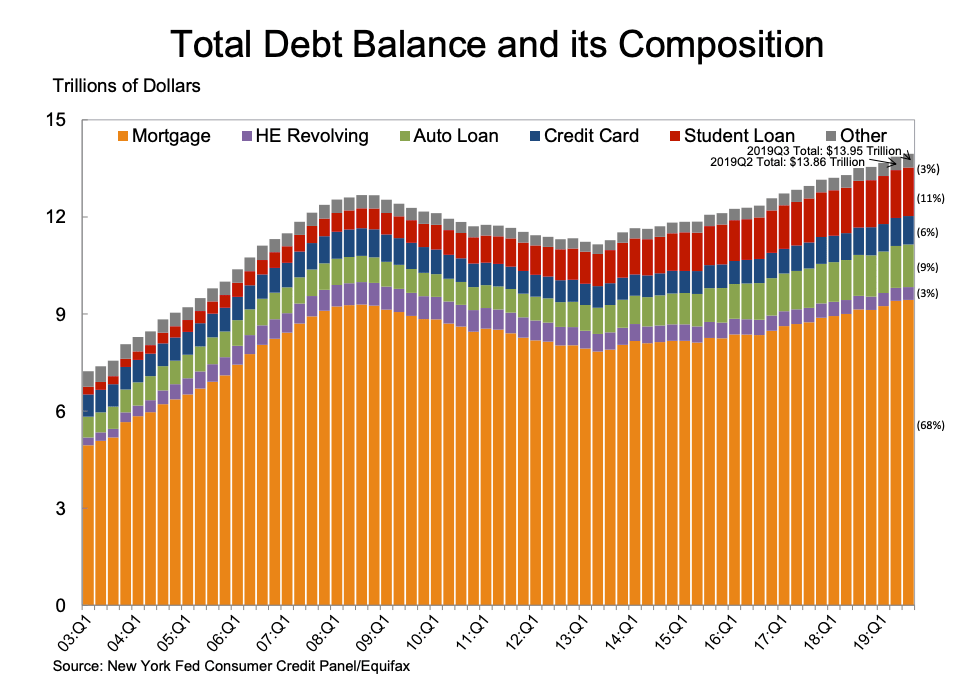

Looking at the below chart for the total debt balance and its composition, for me is interesting how the majority (68%) of the debt population it’s on their mortgage balance.

One hack for this it would use a technique known as House Hacking. In another post I will go in detail on this technique but:

Simply put, House Hacking is a strategy that involves renting out portions of your primary residence to generate income that is used to offset the cost of your mortgage and other expenses associated with owning a home.

Alright now let’s examine the most interesting part of the quote:

Once you have under control your finances let’s cover the interesting part of the snow-ball effect.

“Compound interest is the eighth wonder of the world. He who understands it, earns it”.

This is the whole enchilada my friend. Couple months ago I read a Huffington Post story about a woman celebrating her 100th year as a customer of a local bank. Her father deposited $6.11 into her account 98 years ago, when she was only two years old.

How much would $6.11 be worth today?

The Value of $6.11 98 Years later

| Annualized Return | Value in 98 years |

|---|---|

| 2% | $42.55 |

| 6% | $1,845.08 |

| 10% | $69,586.40 |

| 20% | $351,401,266.90 |

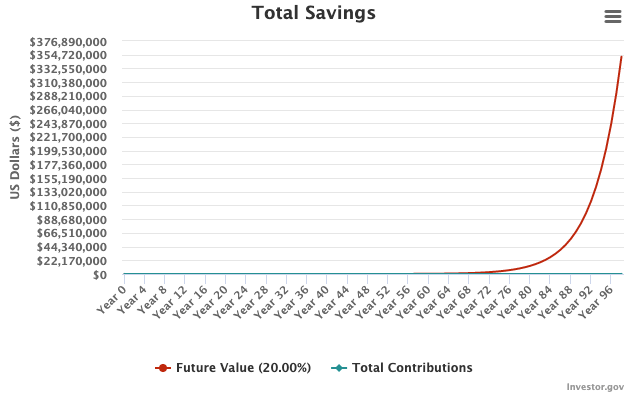

I know you young fellas don’t believe me, Ohh well, here you can see it in the chart.

Neither the article nor the bank said how much the $6.11 had grown however look at “The power of compounding” with a 10% and the insane 20%. Yep you read it well it is $351.4M.

Conclusion

The takeaway here is to start as early as possible to invest and let the compound interest (snow-ball effect) do the magic.

If you follow my lessons and this blog we can easily get between 8%~20% yearly return of investment with low volatility. Stay tuned and don’t forget to share this blog.

Comment: What’s one thing you learned in this post?

Topics

Related Posts

Quick Links

Legal Stuff